as an exempt individual or because of a medical condition that arose while you were in the U.S. If you do not timely file Form 8843, you cannot exclude the days you were present in the U.S. If you do not have to file an income tax return, send Form 8843 to the address indicated in the instructions for Form 8843 by the due date for filing an income tax return. because of a medical condition or medical problem, you must include Form 8843, Statement for Exempt Individuals and Individuals With a Medical Condition, with your income tax return. for purposes of the substantial presence test because you were an exempt individual or were unable to leave the U.S. If you exclude days of presence in the U.S.

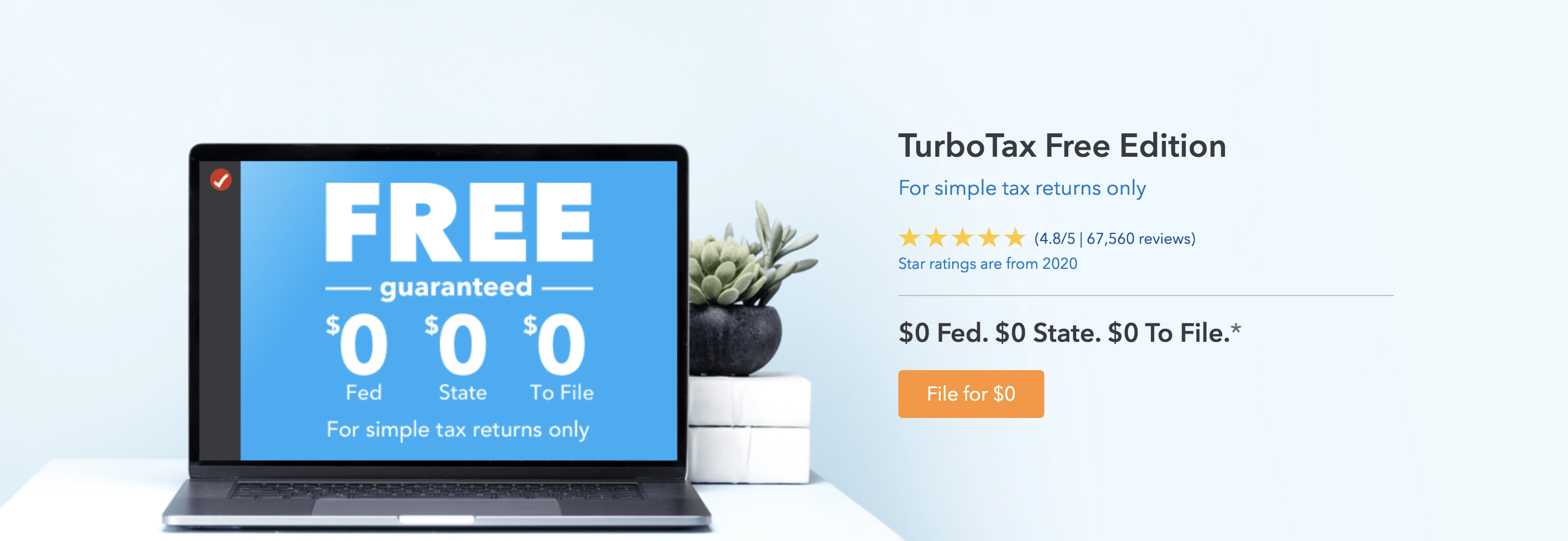

#Turbotax canada online professional

The seabed and subsoil of those submarine areas that are adjacent to U.S.The territorial waters of the United States.All 50 states and the District of Columbia.The term United States (U.S.) includes the following areas: Days you are an exempt individual (see below).įor details on days excluded from the substantial presence test for other than exempt individuals, refer to Publication 519, U.S.because of a medical condition that develops while you are in the United States. for less than 24 hours, when you are in transit between two places outside the United States. from a residence in Canada or Mexico if you regularly commute from Canada or Mexico. Do not count the following as days of presence in the U.S. However, there are exceptions to this rule. on any day you are physically present in the country, at any time during the day.

Since the total for the 3-year period is 180 days, you are not considered a resident under the substantial presence test: for 2023.

#Turbotax canada online full

To determine if you meet the substantial presence test for 2023, count the full 120 days of presence in 2023, 40 days in 2022 (1/3 of 120), and 20 days in 2021 (1/6 of 120). on 120 days in each of the years 2021, 20.

0 kommentar(er)

0 kommentar(er)